Offshore Company Formation: Browse International Waters Safely

Offshore Company Formation: Browse International Waters Safely

Blog Article

Strategies for Cost-Effective Offshore Business Development

When taking into consideration overseas firm formation, the quest for cost-effectiveness comes to be an extremely important concern for businesses seeking to expand their operations internationally. In a landscape where financial prudence preponderates, the methods employed in structuring overseas entities can make all the difference in accomplishing financial performance and functional success. From browsing the intricacies of jurisdiction option to executing tax-efficient frameworks, the trip towards developing an overseas visibility is raging with challenges and chances. By checking out nuanced methods that blend lawful compliance, monetary optimization, and technical developments, organizations can start a path towards offshore company formation that is both economically prudent and purposefully sound.

Choosing the Right Jurisdiction

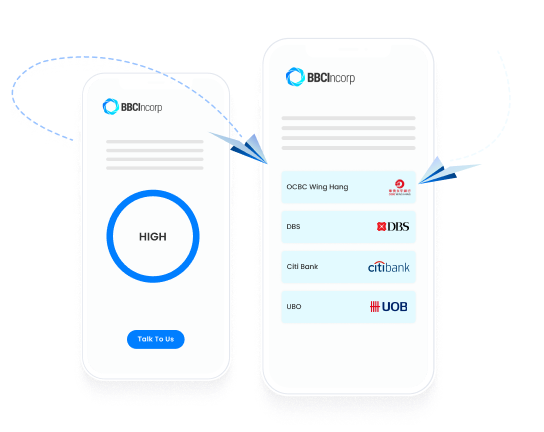

When developing an offshore business, selecting the ideal jurisdiction is an essential decision that can substantially influence the success and cost-effectiveness of the formation procedure. The jurisdiction chosen will identify the governing framework within which the company operates, affecting tax, reporting requirements, privacy laws, and general service adaptability.

When choosing a jurisdiction for your offshore business, numerous variables have to be thought about to ensure the choice lines up with your tactical objectives. One critical aspect is the tax routine of the jurisdiction, as it can have a considerable effect on the firm's earnings. In addition, the level of governing compliance required, the economic and political security of the jurisdiction, and the simplicity of doing organization has to all be examined.

Furthermore, the reputation of the jurisdiction in the worldwide business area is essential, as it can influence the assumption of your business by customers, partners, and economic institutions - offshore company formation. By meticulously assessing these variables and seeking expert recommendations, you can select the right jurisdiction for your offshore firm that maximizes cost-effectiveness and sustains your company objectives

Structuring Your Business Successfully

To make certain optimal effectiveness in structuring your offshore firm, thorough interest should be offered to the business structure. The primary step is to specify the firm's ownership framework clearly. This consists of determining the investors, officers, and directors, in addition to their duties and duties. By developing a transparent ownership framework, you can make sure smooth decision-making procedures and clear lines of authority within the company.

Next, it is necessary to take into consideration the tax effects of the selected framework. Various jurisdictions offer varying tax benefits and rewards for offshore business. By thoroughly assessing the tax regulations and laws of the selected territory, you can optimize your business's tax obligation efficiency and minimize unneeded costs.

In addition, preserving appropriate paperwork and documents is crucial for the effective structuring of your overseas company. By maintaining up-to-date and accurate records of financial purchases, business choices, and conformity records, you can guarantee transparency and accountability within the organization. This not only assists in smooth procedures yet likewise helps in showing conformity with governing demands.

Leveraging Modern Technology for Cost Savings

Efficient structuring of your overseas firm not only hinges on careful focus to organizational frameworks however also on leveraging technology for financial savings. One method to utilize modern technology for savings in overseas company development is by making use of cloud-based services for information storage and collaboration. By visit this site incorporating technology tactically into your overseas company formation process, you can accomplish significant cost savings while improving functional efficiency.

Decreasing Tax Obligations

Utilizing strategic tax obligation preparation strategies can successfully decrease the economic burden of tax obligation responsibilities for overseas firms. One of one of the most usual approaches for minimizing tax liabilities is via profit shifting. By dispersing earnings to entities in low-tax territories, offshore firms can lawfully decrease their total tax obligation commitments. In addition, benefiting from tax incentives and exemptions used by the jurisdiction where the overseas firm is signed up can cause significant cost savings.

An additional strategy to minimizing tax obligation responsibilities is by structuring the overseas company in a tax-efficient manner - offshore why not try here company formation. This involves thoroughly designing the ownership and operational framework to maximize tax obligation advantages. As an example, establishing up a holding business in a jurisdiction with favorable tax obligation laws can assist consolidate profits and reduce tax obligation exposure.

Moreover, staying upgraded on global tax regulations and conformity requirements is essential for lowering tax obligation responsibilities. By making sure stringent adherence to tax obligation laws and guidelines, offshore companies can prevent costly penalties and tax conflicts. Looking for specialist advice from tax obligation professionals or lawful experts specialized in global tax matters can additionally give beneficial understandings right into reliable tax obligation preparation approaches.

Making Sure Conformity and Threat Mitigation

Carrying out durable compliance measures is important for overseas firms to mitigate risks and keep regulative adherence. Offshore territories commonly face boosted analysis as a result of problems pertaining to cash laundering, tax obligation evasion, and other economic criminal offenses. To make certain compliance and mitigate risks, overseas business should perform extensive due persistance on customers and business i was reading this companions to avoid involvement in illicit tasks. Additionally, implementing Know Your Client (KYC) and Anti-Money Laundering (AML) procedures can aid confirm the authenticity of transactions and guard the firm's track record. Routine audits and reviews of financial records are vital to determine any abnormalities or non-compliance problems without delay.

Additionally, remaining abreast of altering policies and lawful requirements is important for offshore companies to adapt their compliance techniques as necessary. Involving legal experts or conformity professionals can offer valuable assistance on browsing intricate regulatory landscapes and ensuring adherence to global criteria. By focusing on compliance and risk reduction, overseas firms can enhance openness, construct count on with stakeholders, and safeguard their procedures from prospective legal repercussions.

Verdict

Making use of critical tax planning methods can efficiently lower the monetary concern of tax responsibilities for offshore firms. By distributing earnings to entities in low-tax territories, offshore business can lawfully decrease their total tax obligation obligations. Furthermore, taking advantage of tax obligation motivations and exemptions supplied by the territory where the offshore company is signed up can result in substantial savings.

By ensuring rigorous adherence to tax obligation laws and guidelines, overseas companies can avoid costly fines and tax disagreements.In verdict, cost-efficient offshore firm development needs cautious consideration of territory, effective structuring, technology usage, tax reduction, and compliance.

Report this page